Shipping valuable goods, whether across town or halfway around the world, always comes with a degree of risk. From accidents on the road to turbulent seas and delays in the air, there’s always the chance that something could go wrong. That’s where cargo insurance steps in—providing peace of mind and protection for your shipments, no matter the distance or mode of transport. Whether you’re a business owner, logistics manager, or someone curious about how these processes work, understanding cargo insurance is crucial. In this guide, we’ll break down the three main types of cargo insurance, Land/Haulier, Marine, and Air, and highlight the specific coverage options that help keep your goods safe from unexpected events.

1. Land/Haulier Cargo Insurance

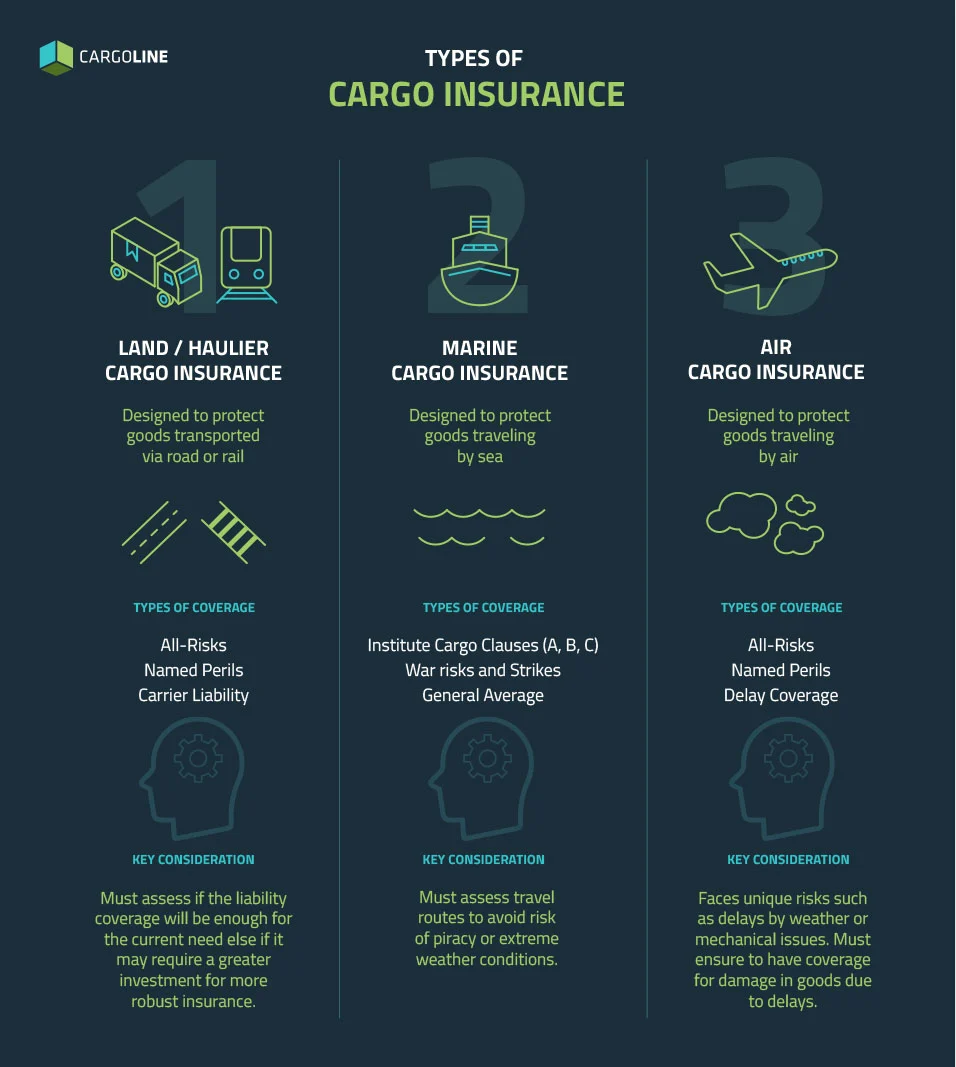

Land or haulier cargo insurance is designed to protect goods transported via road or rail. It is particularly relevant for companies that rely on trucking services to move their cargo within a country or across borders.

Coverage Categories for Land/Haulier Cargo Insurance

- All-Risks Coverage: This is the most comprehensive form of coverage, providing protection against all types of risks except for those explicitly excluded in the policy. Events like accidents, theft, fire, and even vandalism are typically included.

- Named Perils Coverage: Unlike all-risks coverage, named perils coverage only protects against specific risks listed in the policy. For example, you might have coverage for fire, collision, or theft, but if damage occurs due to an unlisted peril like flooding, you won’t be covered.

- Carrier Liability: It’s essential to understand that hauliers or carriers may also offer a form of liability coverage, but this typically covers only a fraction of the cargo’s total value. Carrier liability protects against the haulier’s negligence but won’t provide compensation for natural disasters or other unexpected events.

Key Considerations for Land/Haulier Cargo Insurance

Since land/haulier cargo insurance is designed to cover the journey by road or rail, it often includes provisions for vehicle accidents, theft, and mishandling. However, companies should always assess whether the haulier’s liability coverage will be enough to meet their needs, or if they should invest in a more robust cargo insurance policy.

2. Marine Cargo Insurance

Marine cargo insurance protects goods traveling by sea and has been a cornerstone of global trade for centuries. As international commerce continues to expand, this type of insurance is more vital than ever for businesses shipping goods over long distances.

Marine insurance doesn’t stop at the ocean—it can also cover your cargo as it travels from the port to its final destination. For businesses relying on global shipping routes, knowing how this insurance works is essential to protect your shipments from potential risks at every stage of the journey.

Coverage Categories for Marine Cargo Insurance

- Institute Cargo Clauses (A, B, C): Marine Cargo Insurance is typically broken down into three primary types of clauses (A, B, and C) each offering varying levels of coverage.

- Institute Cargo Clauses (A): This is the most comprehensive form of marine insurance and provides all-risk coverage. It covers a wide range of incidents, including natural disasters, accidents, and theft. However, it still excludes specific events such as strikes and civil unrest unless added by an extension.

- Institute Cargo Clauses (B): This offers intermediate coverage, protecting against named perils like fire, explosion, vessel sinking, or being stranded, but excluding more common incidents such as theft.

- Institute Cargo Clauses (C): The most basic type of coverage, protecting against only major catastrophes like vessel sinking or stranding. It does not cover incidents like theft, piracy, or accidental damage during loading and unloading.

- War Risks and Strikes Insurance: Many marine insurance policies exclude coverage for risks related to war, strikes, or terrorism. However, businesses can opt to add these as extensions for more comprehensive protection. This is particularly relevant for cargo traveling through politically unstable regions.

- General Average: A unique aspect of marine cargo insurance is the principle of “General Average,” which involves shared financial responsibility for any loss. If, for example, a portion of the cargo needs to be sacrificed to save the rest of the shipment, the losses are shared proportionally among all cargo owners. Marine cargo insurance helps to cover these shared costs.

Key Considerations for Marine Cargo Insurance

When choosing marine cargo insurance, companies must assess the route their goods will take and consider the additional risks like piracy or extreme weather conditions. Furthermore, since coverage varies significantly across clauses A, B, and C, it’s important to understand the limitations and advantages of each.

3. Air Cargo Insurance

Air cargo insurance provides coverage for goods transported by air, which is often the fastest but most expensive mode of transportation. Air cargo is frequently used for high-value, time-sensitive shipments, making insurance critical for protecting these valuable goods.

Coverage Categories for Air Cargo Insurance

- All-Risks Coverage: Similar to land and marine cargo, all-risks coverage for air cargo provides comprehensive protection against most perils, including damage, theft, and loss during the journey. However, events like war, civil unrest, and natural disasters might not be included without additional coverage.

- Named Perils Coverage: Businesses that are looking to reduce insurance costs might opt for a named perils policy, which will cover specific risks like fire, collision, and crashes but may exclude other events like mishandling during loading or unloading.

- Delay Coverage: One of the key concerns with air cargo is the risk of delays, which can be costly for businesses relying on just-in-time inventory. Air cargo insurance policies sometimes offer delay coverage as an add-on, compensating for losses incurred due to missed deadlines or spoiled perishable goods.

Key Considerations for Air Cargo Insurance

While air transport is generally safer and faster than sea or road transport, it comes with its own unique risks. Delays caused by adverse weather or mechanical issues can severely impact a business’s supply chain. Companies shipping perishable goods like pharmaceuticals or fresh produce should ensure they have coverage for delays or damage due to extended time in transit.

Additional Considerations for Cargo Insurance

While the three main types of cargo insurance each have their own set of risks and coverage options, it’s important for businesses to carefully evaluate their specific needs when choosing a policy. Factors such as the value of the cargo, the likelihood of theft or damage, and the transportation route all play a role in determining the right level of insurance coverage. Below are a few additional considerations that apply to all types of cargo insurance:

- Exclusions: Every cargo insurance policy will come with exclusions, such as damage due to inadequate packaging, inherent vice (natural deterioration of goods), or delays caused by customs. Businesses need to fully understand what is and isn’t covered to avoid unpleasant surprises later.

- Extensions: Many insurance providers offer optional extensions to enhance the scope of coverage. These can include coverage for high-risk areas, protection against strikes, and war risks.

- Claims Process: The claims process is another important factor to consider. Some insurers may have lengthy or complicated claims procedures, which can delay compensation. Companies should opt for insurers with straightforward claims processes and good reputations for quick settlements.

Protect Your Shipments with Tailored Cargo Insurance Solutions from Cargoline

Cargo insurance is a vital component of protecting your shipments against unforeseen risks, whether they are traveling by land, sea, or air. Each type of cargo insurance comes with its own coverage options and risk profiles. By understanding the specific needs of your business and the inherent risks in your transportation routes, you can choose the right type of coverage and ensure your goods are well-protected throughout their journey.

At Cargoline, we offer tailored cargo insurance solutions designed to safeguard your shipments every step of the way. Whether you’re shipping by road, sea, or air, our team is here to help you navigate the complexities of cargo insurance and ensure your goods arrive safely. Contact us today to find out how we can protect your business.