August 2022

Easily Find CEPA Duty Rates With This tool

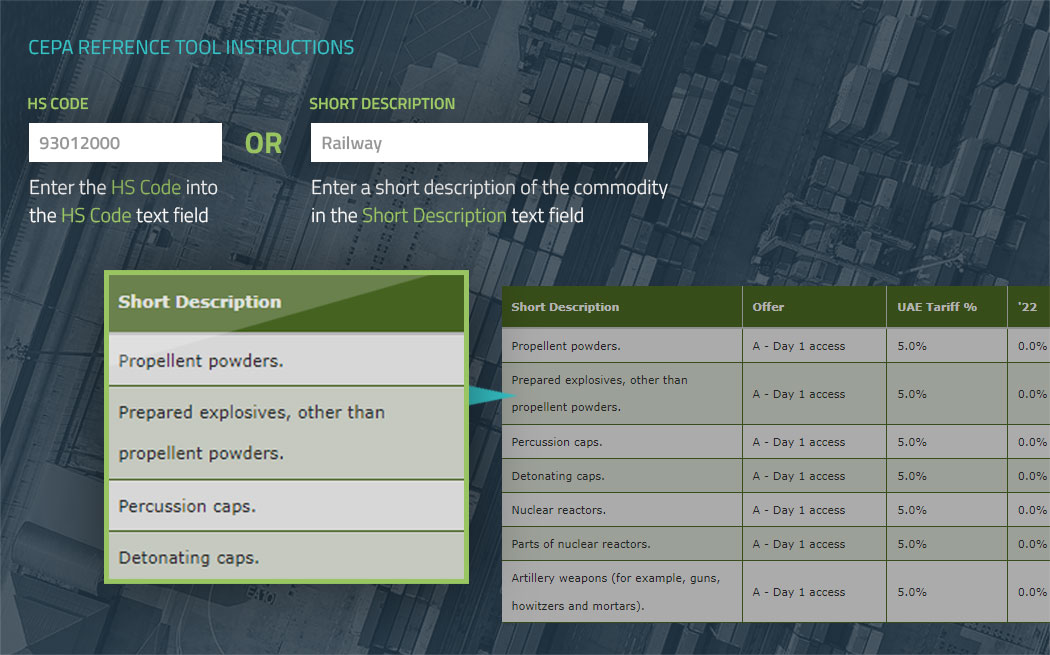

In order to make things simpler for our customers, we at Cargoline have developed a dynamic reference search tool to help quickly find custom duties for commodities.

Understanding the table output

The year progression (starting from 1st of May, 2022) illustrates that % value of custom duties across commodities

The offer details are as follows:

| Offer | Description | Details |

| A | Day 1 access | CEPA starts with duty |

| C | Access at year 5 | Duty upto 5 years |

| E | Access at year 10 | Duty upto 10 years |

| G | Prohibited product | Cannot be imported to UAE |

| F | Excluded | Do not fall under CEPA |

| H | Special goods | Requires special approval before import |

| TR | Tariff Reduction | Duty exemptions |

INDIA-UAE CEPA Reference Tool

Get an eBook version of the Reference Guide

Disclaimer

Cargoline is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this document is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information.

For more information you can read our article on India-UAE CEPA benefits for your business.

Feel free to reach out to us if you have any queries.