January 2024

Easily Find CEPA Duty Rates With This tool

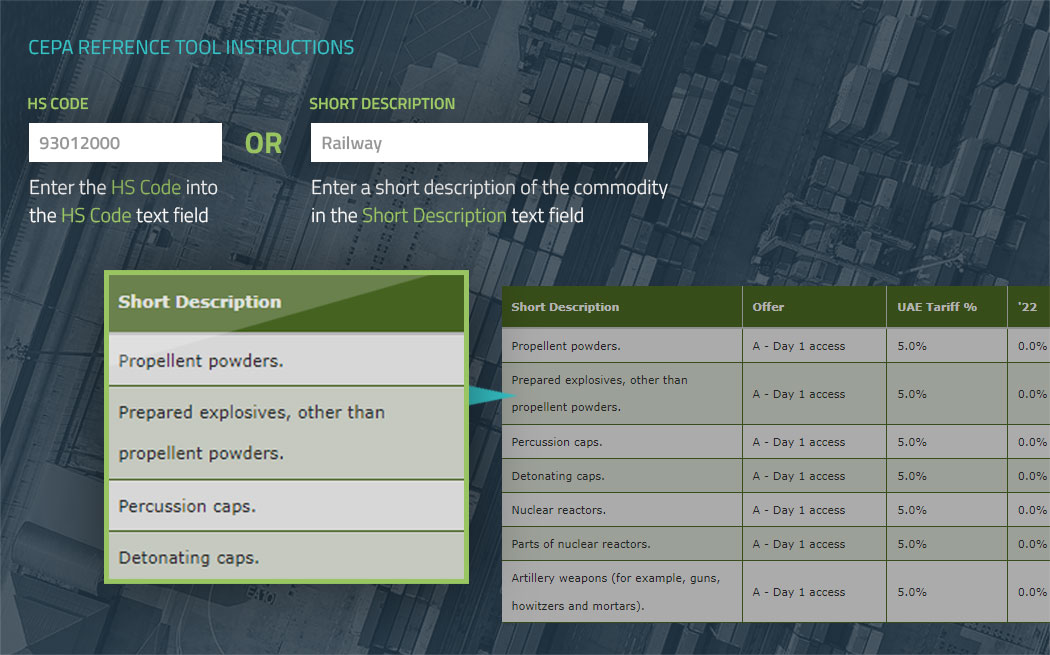

In order to make things simpler for our customers, we at Cargoline have developed a dynamic reference search tool to help quickly find custom duties for commodities.

Understanding the table output

The year progression (starting from 1st of April, 2022) illustrates that % value of custom duties across commodities

Table Fields Legend:

| Fields | Details |

| Is Tariff Line | No. of Tariff Lines |

| Description | Commodity details |

| Measurement Unit | Each per unit / Kilogram |

| General Rate | Duty Free OR New Israeli Shekel (NIS) |

| WTO – MFN Rate | World Trade Organization – Most favoured Nation Rate |

| WTO – Quota | World Trade Organization – Quota applicable or not |

| WTO – within Quota rate | World Trade Organization – Applicable Quota rate or Duty Free |

| 01/04/2022 | Quota from April 2022 |

UAE to Israel CEPA Reference Tool

| wdt_ID | HS Code | Is Tariff Line? | Description | Measurement Unit | General Rate | WTO - MFN Rate | WTO - Quota | WTO - within Quota Rate | 01/04/2022 |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 1 | 0 | Chapter 1: Live animals | ||||||

| 2 | 101 | 0 | .LIVE HORSES, ASSES, MULES AND HINNIES | ||||||

| 3 | 10120 | 0 | horses | ||||||

| 4 | 101210000 | 1 | Pure-bred breeding animals | Each (per unit) | Duty Free | No | 0 | ||

| 5 | 101290000 | 1 | Other | Each | Duty Free | No | 0 | ||

| 6 | 101300000 | 1 | Asses | Each | Duty Free | No | 0 | ||

| 7 | 101900000 | 1 | OTHERS | Each | Duty Free | No | 0 | ||

| 8 | 102 | 0 | .LIVE BOVINE ANIMALS | ||||||

| 9 | 10220 | 0 | : Cattle | ||||||

| 10 | 102210000 | 1 | Pure-bred breeding animals | Each | Duty Free | Yes | Duty Free | 0 |

Get an eBook version of the Reference Guide

Disclaimer

Cargoline is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this document is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information.

For more information you can read our article on India-UAE CEPA benefits for your business.

Feel free to reach out to us if you have any queries.